The debt collection agency is driven by payments. Businesses rely on collection agencies to assist in recovering unpaid debts from customers. At Process Payments Now, we understand the complexities of the collection agency merchant account and what it takes to ensure compliance while balancing the ease of payments for debtors.

The collection industry is a $13 billion dollar industry and is growing year after year. According to the Federal Reserve of New York, consumer debt grew by $184 billion dollars in Q1 of 2024.

Given that debt collection agencies rely on payments from debtors, they need a reliable partner to ensure those payments are processed without issues. Typically debt collection agencies take payment by phone/mail. This is generally due to legacy software often referred to as dinosaur software. Process Payments Now works with partners like Maxyfi to offer an integrated payment solution that streamlines collection agency operations.

How do I apply for a debt collection merchant account?

The process for applying for a merchant account for a debt collection agency depends on a few variables. These variables are the age of the business, the chargeback ratio, and the financial health of the debt collection agency.

The first thing that comes into play is the age of a collection agency. Start-up collection agencies will face the most difficulty applying for a payment processing account. Most high-risk providers will not approve a start-up collection agency because they carry the biggest risk for the bank. The main reason this is difficult is due to the lack of history associated with accepting payments.

The second item that the bank is going to consider is the chargeback history of the collection agency. Debt collection agencies deal with a higher volume of chargebacks compared to other business models. If the chargeback ratio is too high, the bank may shut down the processing account for the collection agency. If your collection agency merchant account has been shut down, it is likely your business is listed on the MATCH list.

The final thing that the bank will consider when approving your payment processing account is the financial stability of the debt collection firm. Due to the higher risk associated with the industry, the bank is going to want to see at least 2 years of financials prepared by a CPA. If this is not available for the business, the bank is going to want to see 2 years of financial statements for every owner of the business.

When applying for a merchant account for a debt collection agency, be prepared with the following documentation:

- Photo ID of each owner

- Proof of business bank account

- Six months of business bank statements

- Six months of previous processing statements (if applicable)

- Business financial history

- Personal financial history

- Compliant website

Why choose Process Payments Now for your collection agency merchant account?

The choice is simple – Process Payments Now has the tools for your business to grow. We have more approvals for collection agencies compared to our competitors. We work with start-up collection agencies as well as existing collection agencies.

One of the biggest advantages we have over other providers is our ability to accept cash payments at major retailers like Walmart, Dollar General and more. This allows collection agencies to collect payments from more debtors, including those that do not have a bank account or debit card.

We provide hassle free integrations to the top collection agency softwares in the industry. We also have advanced tools and resources to protect collection agencies against chargebacks.

Our collection agency merchant accounts have the lowest fees in the industry. We beat our competitors pricing by up to 80%. In addition, we do not charge any “junk-fees” that is so common with other payment processors.

Process Payments Now is not just a payment provider, we are a partner in your collection agencies success.

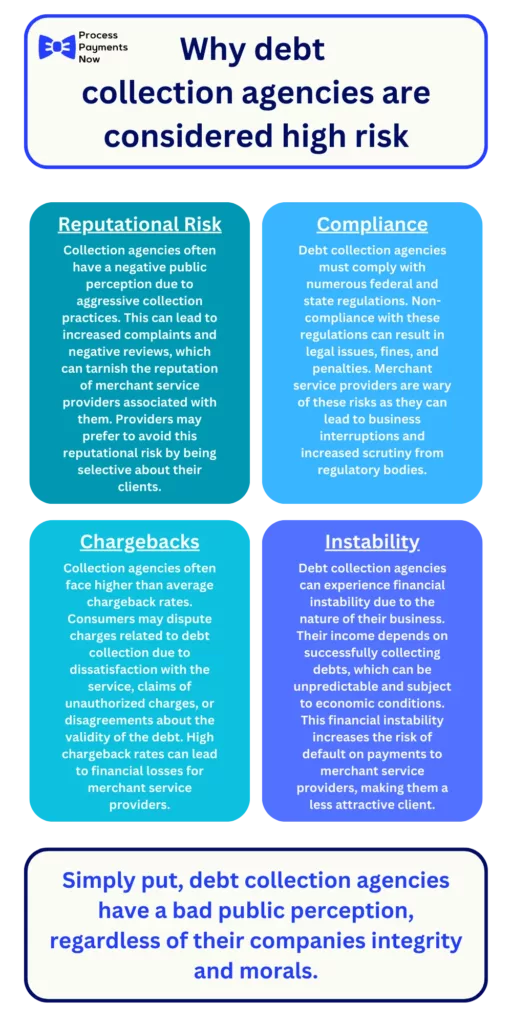

Why are collection agency merchant accounts high risk?

If you work with collection agency merchant accounts, it is important to know that they will always be deemed high-risk by the processing bank. Process Payments Now understands the complexities of working with high-risk merchants and has tailor solutions for collection agency merchant accounts.

Debt collection firms are considered high-risk by acquiring banks and credit card processors for a number of reasons. The most common issue for debt collections is chargebacks.

Regardless of a debt collection agencies integrity and morals, the public perception of these firms is generally negative.

The following are the main risk reasons associated with debt collectors:

- Compliance

- Chargebacks

- Reputational risks

- Inconsistent recurring billing

Compliance

There are many laws and regulations that control the debt collection industry. Of these laws, the Fair Debt Collection Practices Act (FDCPA) is the main law that guides the industry. When an underwriter is evaluating whether or not to approve a merchant account for a debt collection agency, they are going to research the firms compliance with the FDCPA.

If the collection agency has multiple documented violations of the FDCPA, the agency might not get approved for processing.

Debt Collection Chargebacks

Chargebacks are the biggest issue that debt collection agencies face when applying for a merchant account. If the agency has a high enough chargeback ratio, their merchant account can be terminated and their business can be added to the MATCH list.

The MATCH list, formally know as the TMF list, is a list of merchants that have had their accounts terminated due to fraudulent practices. Once a merchant is placed on the MATCH list, it takes 5 years for that record to be deleted from the database. In the meantime, the merchant may not be able to open a processing account because payment processors must check the MATCH list before approving a merchant.

At Process Payments Now, we provide industry leading tools and resources to protect your collection agency merchant account from ending up on the MATCH list. After switching our collection agency merchants see an average 20% lower chargebacks compared to other providers.

Reputational Risks

It only takes one bad egg to ruin the bunch. Banks and processors typically view collection agencies negatively because of the aggressive action that some firms take in order to collect a payment.

At Process Payments Now, we look beyond the industry reputation and look at each collection agency individually. While there are a lot of bad actors in the industry, there are also a lot of firms that have high integrity.

Recurring Billing

Debt collection agencies often rely on recurring billing to collect on debts. When debtors face financial hardship that prevents them from paying a lump sum, collection agencies offer a payment plan so they can resolve the debt over time. While this is helpful to many debtors, it carries a risk to the collection agency.

The worst-case scenario is that a debtor forgets about an automatic payment, contests the charge, and calls their bank to request a chargeback.

Process Payments Now has built in solutions for collection agencies that protects against chargebacks and ensures that in the event of a chargeback, the collection agencies has the proof necessary to win.

Are law firms that practice debt collection high-risk?

Yes, even law firms that practice debt collection are considered high-risk by payment processors. Although one could argue that a law firm that practices debt collection is more likely to be compliant, that does not stop debtors from placing chargebacks.

The biggest mistake that a payment processor will do when opening a debt collection law firm account is incorrectly categorize them. If a debt collection law firm is assigned the wrong Merchant Category Code (MCC), it can create a lot of risk down the road for the law firm to end up on the MATCH list.

If a debt collection law firm practices other forms of law, they should have a separate merchant account for the debt collection practice. If your firm is collecting payments from the same merchant account that you charge other clients, it is time to reach out to Process Payments Now.

How do collection agency merchant accounts differ from regular merchant accounts?

Besides the fact that debt collection merchant accounts are labeled as high-risk, there are other things that differentiate their accounts. The main way these accounts differ from regular payment processing accounts is the inability to take credit card or charge card payments.

Essentially, a debtor cannot pay off a debt by incurring more debt. For this reason, debt collection merchant accounts are only able to accept Visa and MasterCard debit cards. Collection agencies are not allowed to accept payments with credit cards. They are also not allowed to accept payments from American Express or Discover.

Another major difference between collection agency merchant accounts and other accounts are rolling reserves. Often, banks will require debt collection firms to have a rolling reserve on their account. A rolling reserve is a percentage of sales that is kept with the acquiring bank to mitigate their loss from chargebacks. Some processors may never remove the rolling reserve, regardless of the age of the agency.

Process Payments Now ensures that collection agencies with a low chargeback ratio do not have to deal with rolling reserves and advocates for our clients behalf to remove reserves after they have proven they are not running a risky practice.

Can you use Stripe, Square or PayPal for debt collection payment processing?

No, debt collection agencies are not allowed to use Stripe, Square or PayPal for collecting debts. These companies are called payment facilitators, meaning that you are not setup with an individual merchant identifier. These companies use a single merchant identifier for all of their transactions. Because of this, they must keep their eco-system clear of high-risk merchants that have the possibility of high chargebacks.

While these companies will initially approve your account, it is only a matter of time before they catch on and shut your account down. Once they shut your account down, they will put your funds on hold for 180 days. You cannot access your funds while on hold and their support will not release the funds, no matter what you try to do.

In most cases, funds on hold will be returned to the original card holder and you will need to recollect on those debts. This can make these debts extremely hard to collect on because debtors will become frustrated and lose trust in your firm.

Process Payments Now works with collection agencies to setup their accounts the right way, ensuring that all the regulatory compliance around collecting payments is done properly.

Can I accept ACH payments from my debtors?

Yes, collection agencies are allowed to accept payments through the Automated Clearing House (ACH) network.

The main advantage of processing ACH payments is the funds are taken directly from the debtor’s bank accounts. In general, ACH payments expose you to less risk than cards.

In addition, ACH payments are much more cost effective compared to accepting cards.

If you are a commercial collection agency working primarily with business to business debt, ACH significantly reduces your exposure to chargebacks because the chargeback window is only a few days compared to a few months with card payments.

Choosing the best debt collection merchant account

Finding the best payment processing for your debt collection agency is not an easy task. When selecting your merchant provider it is important to consider the payment processors ability to work with high-risk businesses.

Transparency is the most important thing to consider when choosing your payment processor. Many merchant providers will gladly accept your collection agency knowing that you are high-risk so they can include a bunch of hidden fees. If you figure out about these hidden fees they will often use that excuse that these must be charged due to the risk associated with a debt collection merchant account. This is simply not true.

Fees vary from processor to processor and it is important to ask about this upfront.

Another important thing to consider is the payment processors experience with collection agencies. Many payment processors advertise themselves as high-risk processors, however, many do not have experience with collection agency merchant accounts.

If you choose Process Payments Now, you are choosing a merchant services company that has experience, offers total transparency on pricing and technology to help protect you against chargebacks.

Another thing to consider about your payment processing account is the method of payment you often accept. Based on the way you accept payments determines the best technology for your account. Having a payment processor that can provide integrated payment solutions can significantly reduce the amount of time and effort it takes for your collectors to accept and reconcile payments.

Process Payments Now is the best option for a debt collection merchant account. We provide the best support, innovative solutions, and our years of expertise working with collection agencies.

Final Thoughts

Payment processing for debt collection agencies is complex and requires proper planning for seamless execution. Process Payments Now simplifies this entire process for collection agency merchant accounts.

Complete our online application today and partner with Process Payments Now to revolutionize your payment acceptance.