Knock-knock, it’s another cold call! This time, about payment processing—uh oh! Ever found yourself on the line with a persistent salesperson who, when given the stage, can’t even clearly sketch what they’re peddling? Us too!

My name is Scott Waters and I will be your guide on the journey through one of the most boring but most important topics for entrepreneurs, credit card processors. I owned a retail store for close to a decade and used my fair share of crappy credit card processors and point of sale systems. Now I help business owners navigate the headache of optimizing operational workflows.

Welcome to my quick, easy-to-understand guide on payment processing. No jargon, no fancy talk, just real, digestible info! My goal is to turn the dry chat about credit cards, transactions, and secure payments into a fun conversation. Let me do the heavy lifting so you can sit back, sip your coffee, and finally know what on earth payment processing really means.

Key Takeaways

- Payment processing is a crucial business mechanism enabling secure monetary transactions between customers and businesses.

- Payment processing costs vary based on transaction type and risk, and while it has challenges like potential fraud and data breaches, adopting modern methods like mobile payments enhances customer convenience and can boost business.

- Selecting a fitting payment processor can streamline operations, improve cash flow, and greatly influence business success.

What Is The Meaning of Payment Processing?

Payment processing is the bank to bank communication that enables individuals and businesses to make and receive payments for goods or services. When you purchase something online or swipe your card at a store, payment processing is what ensures the money moves from your account to the seller’s account smoothly and securely.

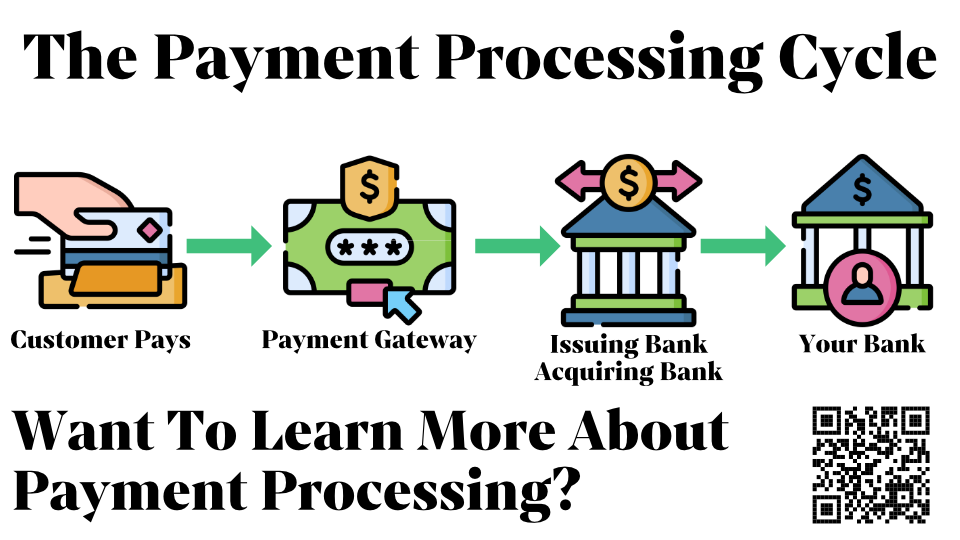

Here’s how it works in simple terms: When you make a payment, the payment details you provide, such as your card information or digital wallet credentials, are sent to a special intermediary called a payment gateway. This gateway then checks if you have enough funds in your account or sufficient credit to complete the transaction. It also verifies the authenticity of the payment to prevent any fraudulent activity.

Once your payment is authorized, the payment gateway sends a request to the bank that issued your payment method, known as the issuing bank. The issuing bank confirms that the transaction is valid and that you have enough funds or credit available. If everything checks out, the issuing bank transfers the funds to the seller’s bank, which is called the acquiring bank. The acquiring bank then deposits the money into the seller’s account, allowing them to receive the payment for the product or service they provided.

Throughout this entire process, your customer’s payment details are kept secure through encryption and other advanced security measures to protect your sensitive information. Payment processing is a crucial part of modern commerce, making it possible for businesses to accept a variety of payment methods and ensuring that transactions can be completed smoothly and securely for both buyers and sellers.

How Long Does Payment Processing Take?

The short answer, a few days. The long answer is more complicated and depends heavily on the deal you signed with your current payment processor. Some merchant services companies will offer same day funding (typically for an added fee) while others require 2-3 days before they deposit the funds into your account.

In this modern day it seems unrealistic to wait 2-3 days to receive your funds from sales. In most cases, we can provide businesses with same day funding for their credit card processing account. That means no more waiting for the money you already earned.

How Long Does It Take To Get Started?

In most cases, signing up for a payment processing account is relatively easy and takes a day to approve. However, new businesses should expect a few more days as the payment processing company is going to do its due diligence when reviewing your new account. For existing businesses, as long as they provide all the information, they should be able to be setup within a day or two.

It is important to note that high risk merchants or merchants that do not meet the general guidelines to apply will face delays when applying for merchant accounts. If you own a vape store and need a merchant services account fast, we can help! We also work with collection agencies who need a fast setup for a merchant services account.

Final Thoughts

If you are tired of payment processing sales people calling you trying to sell you something they do not even understand, look no further than Process Payments Now. Our straightforward payment services are made for busy business owners like you. We work with all types of merchants including high risk and hard to approve merchants.

Merchant services and payment processing can seem like a difficult process, especially for new business owners. At Process Payments Now, we want to work with you to ensure you have the easiest process possible. Reach out to us today to learn more about our fast and cost-effective payment processing system.