The Future of Merchant Services: How Technology is Reshaping Payment Processing

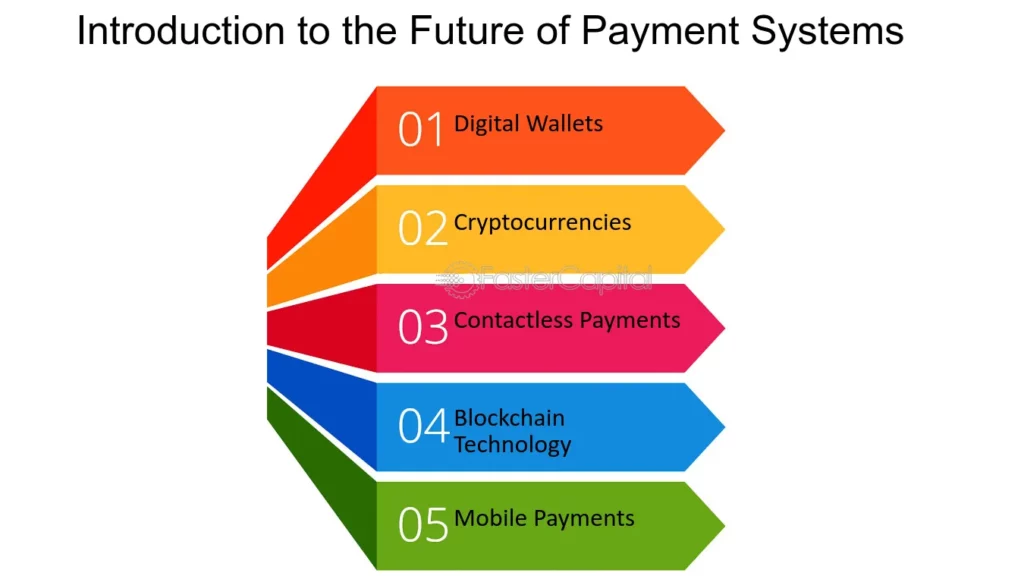

In the ever-evolving landscape of commerce, technological advancements are revolutionizing the way we handle payments. Join us on a journey through the transformative power of emerging technologies in merchant services.

Contactless Payments:

Gone are the days of fumbling for cards or cash. Contactless payments have swiftly become the norm, simplifying transactions with a mere tap. This innovative approach not only offers convenience but also ensures a seamless and hygienic payment experience.

Blockchain-Based Security:

Enter the world of heightened security measures. Blockchain, renowned for its decentralized and tamper-resistant nature, is reshaping the very foundations of payment security. Its adoption ensures airtight encryption, safeguarding transactions from potential threats.

Efficiency Redefined:

Picture a world where payment processing is not just swift but anticipatory. Emerging technologies, fueled by AI and machine learning, are streamlining operations, predicting patterns, and optimizing processes. This not only saves time but also enhances accuracy and efficiency.

User-Friendly Innovations:

The focus isn’t just on securing transactions; it’s about crafting user-centric experiences. Innovations like biometric authentication and intuitive interfaces are revolutionizing how users interact with payment systems, ensuring a seamless and personalized journey.

The Rise of Mobile Wallets:

Mobile wallets have become synonymous with convenience. They empower users to store multiple cards, loyalty programs, and even identification documents—all in one secure digital space. This shift towards mobile-centric transactions is reshaping the way we perceive payments.

Future Horizons:

As we gaze into the future, the possibilities seem boundless. From the integration of IoT devices for smart payments to the potential of cryptocurrency adoption, the trajectory of merchant services is a canvas awaiting further technological brushstrokes.

Embrace the Evolution:

Join us in exploring these groundbreaking innovations that are not just shaping the future but redefining the very essence of payment processing. Witness how technology is not merely a facilitator but a catalyst for efficiency, security, and user-centricity in merchant services.

Discover the future of payment processing—where every transaction is not just a movement of funds but a seamless, secure, and user-friendly experience. Welcome to the next era of merchant services—powered by innovation, driven by technology.

Stay tuned for an in-depth exploration into each of these transformative technologies, uncovering their impact and potential in revolutionizing payment processing as we know it.

Key Takeaways

Key Takeaways:

1. Contactless Payments:

- Convenience meets hygiene with the rise of contactless payments, offering a swift and seamless transaction experience.

2. Blockchain-Based Security:

- Blockchain technology ensures robust security measures, providing tamper-resistant and decentralized encryption for safer transactions.

3. Efficiency Through Technology:

- Technologies like AI and machine learning optimize processes, predict patterns, and enhance accuracy, reshaping payment processing for greater efficiency.

4. User-Centric Innovations:

- Innovations in biometric authentication and intuitive interfaces prioritize user experiences, making payment systems more user-friendly.

5. Mobile Wallets:

- The prevalence of mobile wallets consolidates multiple cards and loyalty programs into secure digital spaces, offering convenience and accessibility.

6. Future Possibilities:

- The future holds promises of IoT-driven smart payments and potential cryptocurrency adoption, marking the horizon of future merchant services.

Conclusion:

The evolution of technology in merchant services isn’t merely about transactions. It’s about redefining the entire payment experience—making it faster, more secure, and exceptionally user-friendly. Embrace this shift toward innovation-driven payment processing, where each transaction is not just a financial exchange but a seamless journey for users and businesses alike.

What Is The Meaning The Future of Merchant Services?

The Future of Merchant Services” encapsulates the evolution and advancements in how businesses handle transactions and payment processing. It refers to the ongoing transformation of payment methods, security measures, and customer interactions within the realm of commerce.

Key Components of “The Future of Merchant Services”:

1. Technological Advancements:

- This future envisions the integration of cutting-edge technologies like AI, blockchain, IoT, and biometrics into payment systems, enhancing security and efficiency.

2. Enhanced Security Measures:

- The future of merchant services emphasizes robust security protocols, such as blockchain-based encryption, to safeguard transactions and protect sensitive data.

3. Convenience and User Experience:

- It focuses on providing seamless, user-friendly payment experiences, with innovations like contactless payments, mobile wallets, and intuitive interfaces.

4. Efficiency and Optimization:

- Merchant services are evolving towards more efficient processes driven by technology, leveraging AI and data analytics to streamline operations and enhance accuracy.

5. Anticipating Future Trends:

- It involves anticipating and preparing for future trends, such as the potential adoption of cryptocurrencies or the utilization of IoT devices for smart payments.

6. Adaptability and Innovation:

- It signifies an adaptable industry that continuously embraces innovation, adapting to changing consumer behaviors and technological advancements.

Overall Significance:

“The Future of Merchant Services” isn’t just about payment transactions; it embodies an entire ecosystem striving for safer, more efficient, and user-centric commerce experiences. It signifies a continual evolution in how businesses handle financial transactions, adapting to technological advancements and catering to the changing needs and preferences of consumers and businesses alike.

How Long Does The Future of Merchant Services Take?

The Future of Merchant Services” isn’t a singular event or process with a defined timeframe. Instead, it’s an ongoing evolution shaped by technological advancements, market trends, regulatory changes, and consumer behaviors.

Factors Affecting the Pace of Evolution:

1. Technology Adoption Rates:

- The speed at which new technologies, such as AI, blockchain, or contactless payments, are adopted by businesses and consumers influences the pace of this evolution.

2. Regulatory Landscape:

- Changes in regulations and compliance requirements within the financial and tech sectors can either facilitate or hinder the adoption and implementation of new payment technologies.

3. Industry Readiness:

- The willingness of businesses to invest in and adopt new technologies, alongside their ability to adapt existing infrastructure, impacts the speed of the evolution of merchant services.

4. Consumer Adoption:

- Consumer acceptance and adoption of new payment methods, like mobile wallets or contactless payments, play a significant role in driving the evolution of merchant services.

5. Innovation and Development:

- The pace of innovation in technology and the development of new solutions—such as advancements in AI-driven payment systems or blockchain applications—determine the trajectory of this evolution.

Continuous Evolution:

“The Future of Merchant Services” is an ongoing journey rather than a fixed destination. It’s characterized by continual advancements, improvements, and adaptations to meet the changing demands of businesses and consumers in an ever-evolving technological landscape.

Conclusion:

There isn’t a definitive timeline for the evolution of merchant services. Instead, it’s a dynamic process that unfolds over time, influenced by various factors that contribute to the adoption, adaptation, and integration of new technologies and practices within the payment processing ecosystem

How Long Does It Take To Get Started?

The time required to get started with the future of merchant services, incorporating new technologies and payment methods, can vary based on several factors:

1. Technology Integration:

- Implementing new technologies, such as adopting AI-driven systems or upgrading to contactless payment methods, can take varying durations depending on the complexity of integration and compatibility with existing systems.

2. Business Preparedness:

- The readiness of a business to adapt to new technologies, including staff training and system adjustments, impacts the time it takes to initiate these changes.

3. Vendor or Provider Setup:

- Engaging with vendors or service providers offering these innovative solutions might involve setup processes that can range from days to weeks, depending on their offerings and support.

4. Regulatory Compliance:

- Compliance with industry regulations and standards, especially in the financial and data security sectors, might add time to ensure adherence to legal requirements.

5. Data Migration and Testing:

- Moving existing data to new systems, testing the functionality, and ensuring everything operates seamlessly can extend the setup time.

6. Customization Needs:

- Customizing solutions to fit specific business requirements might prolong the setup process, depending on the level of customization needed.

7. Decision-Making Processes:

- Decision-making within an organization, including discussions, approvals, and budget allocations, can impact the initiation timeline.

8. Resource Availability:

- Availability of resources, both in terms of manpower and technological infrastructure, can influence how swiftly the setup process can be executed.

In Summary:

The time required to get started with the future of merchant services, incorporating new technologies and innovations, is variable. It depends on the complexity of technology integration, business preparedness, regulatory considerations, customization needs, and the efficiency of decision-making and resource allocation within the organization. Generally, it can range from a few days to several weeks or even longer, depending on these factors.

Final Thoughts

Embracing Tomorrow’s Commerce Today

The future of merchant services isn’t just a distant concept; it’s a reality unfolding before our eyes. As businesses navigate the dynamic landscape of commerce, the integration of cutting-edge technologies isn’t a luxury—it’s a necessity.

An Evolving Ecosystem:

This evolution isn’t a one-time event; it’s a continual journey of adaptation and innovation. The future of merchant services embodies the convergence of convenience, security, and efficiency.

Shaping Experiences:

It’s about crafting experiences where transactions transcend mere exchanges. It’s about contactless payments ensuring seamless interactions and blockchain fortifying security measures.

The Power of Progress:

In this era of rapid technological advancements, we stand at the threshold of unprecedented possibilities—where AI predicts patterns, mobile wallets redefine convenience, and emerging trends shape commerce.

Looking Ahead:

The future of merchant services isn’t just about embracing change; it’s about driving it. It’s about envisioning a world where transactions aren’t just secure and efficient but delightfully user-centric.

Embrace Tomorrow, Today:

Join us on this journey into the future of merchant services. Let’s navigate this landscape of innovation together, where every transaction isn’t just a movement of funds but an experience crafted with technology’s finest.

Step into the future—where innovation isn’t an option; it’s the heartbeat of commerce.